Emerging Technology in Fintech Market Segments Analysis Report 2025-2034

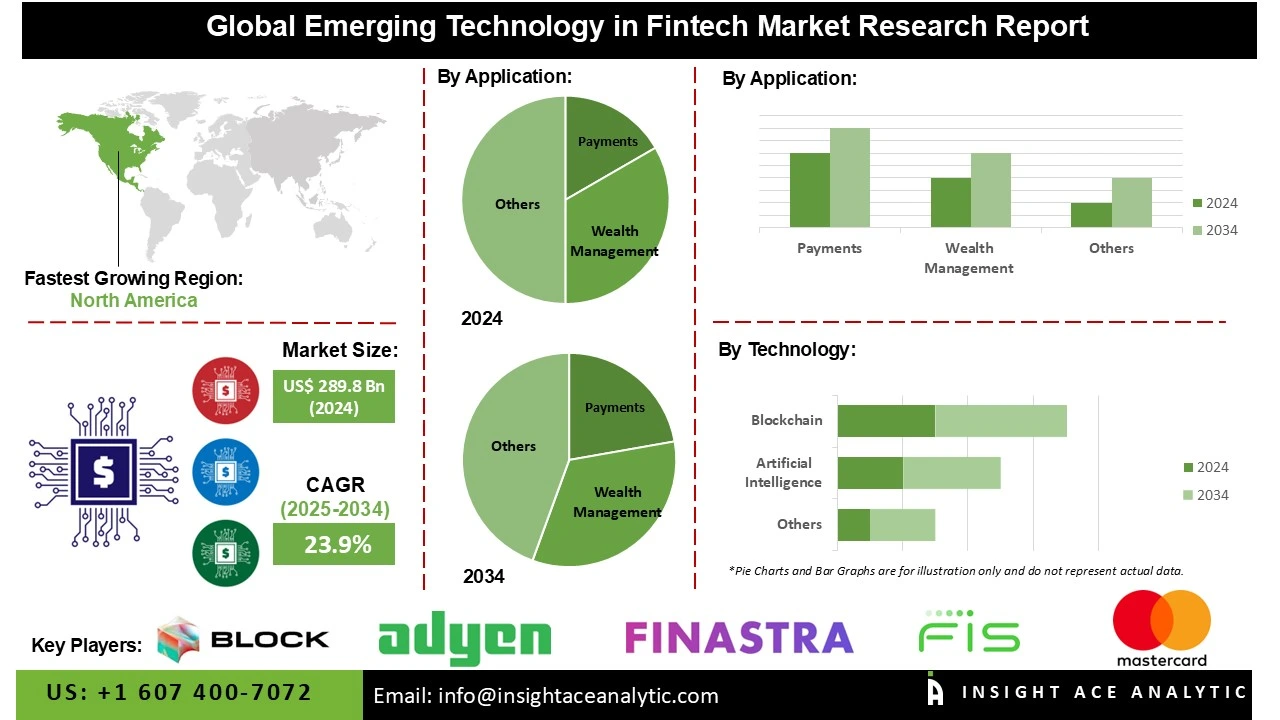

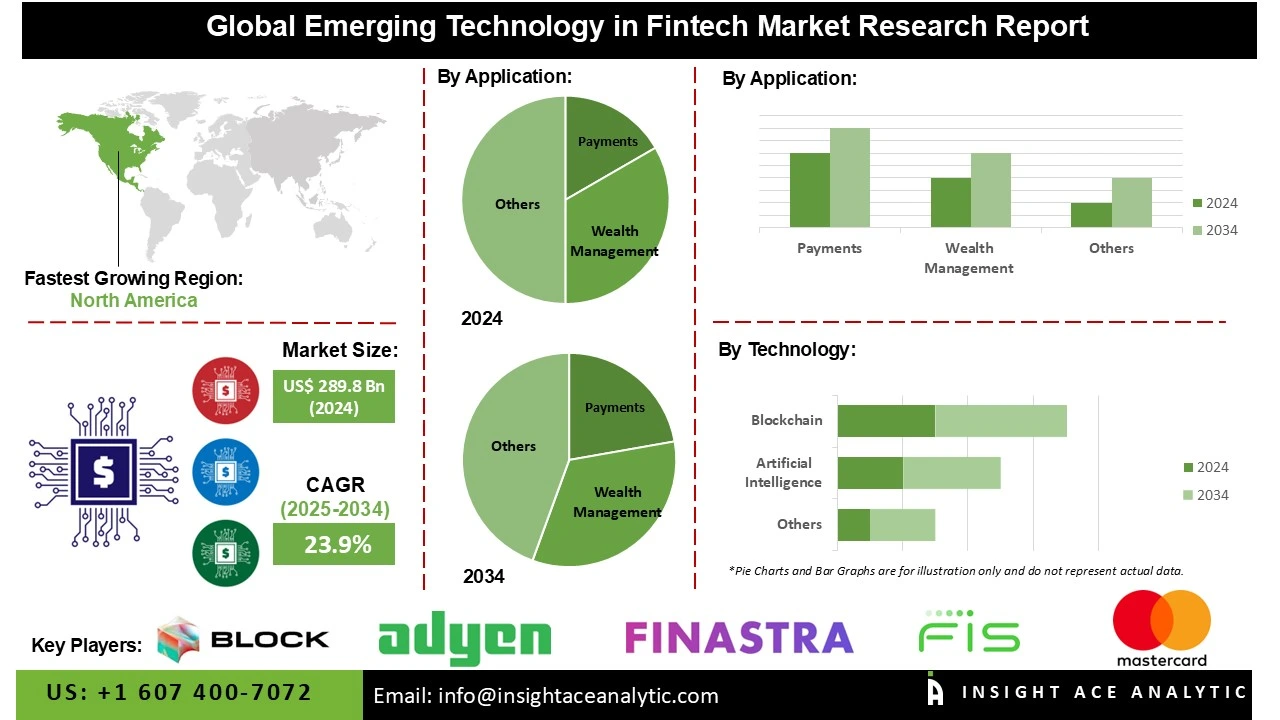

Global Emerging Technology in Fintech Market Size is valued at US$ 289.8 Bn in 2024 and is predicted to reach US$ 2,369.8 Bn by the year 2034 at an 23.9% CAGR during the forecast period for 2025-2034.

Emerging technology in fintech refers to innovative digital tools, such as blockchain, AI, machine learning, big data, and biometrics, that transform financial services by enhancing efficiency, security, accessibility, personalization, and automation across banking, payments, lending, and investment sectors. The new technology within the fintech space is being driven by the accelerating adoption of digital solutions aimed at improving financial accessibility, security, and efficiency.

Significantly contributing to this trend is the growing demand for digital financial services, where customers and enterprises seek quicker, more secure, and more convenient alternatives to conventional banking. Mobile wallets, payment systems utilising blockchain technology, robo-advisors, AI-based credit scoring, and biometric authentication are transforming the delivery of financial services.

The emerging technology in the fintech market is being propelled by rapid digital transformation, growing demand for secure transactions, and customer preference for seamless financial services. Artificial intelligence, machine learning, and big data analytics are powering real-time fraud detection, personalized banking, and automated advisory services. Cloud computing allows scalability and cost savings, while open banking regulations foster collaboration between legacy banks and fintech developers.

Among the key drivers of this change is the evolution of blockchain technology, which offers decentralized, transparent, and tamper-evident transaction records at significantly lower costs and settlement times. North America and Europe are at the forefront of regulatory environments that promote blockchain usage, while the Asia-Pacific region is leading the way in mass adoption, thereby establishing blockchain as the cornerstone of secure digital transactions, cross-border transactions, and smart contracts.

Competitive Landscape

Some of the Key Players in the Emerging Technology in Fintech Market:

· PayPal

· Block, Inc.

· Stripe, Inc.

· Ant Group CO., Ltd.

· FIS

· Adyen

· Finastra

· Mastercard

· Revolut Ltd

· Robinhood

· Goldman Sachs

· N26 SE

· Zelle

· Visa

· Chime Financial, Inc.

Market Segmentation:

The emerging technology in fintech market is segmented by application, technology and By Region. By application, the market is segmented into lending, payments, wealth management, insurance, and others. By technology, the market is segmented into artificial intelligence, blockchain, cloud & edge computing, quantum computing, and others.

By Application, the Payments Segment is Expected to Drive the Emerging Technology in Fintech Market

In 2024, the payments sector held the major market share due to increasing consumer expectations for smooth, real-time experiences. Biometric authentication, contactless payments, and mobile wallets are revolutionising customer interactions, while blockchain and distributed ledger technologies are growing transparency and minimising fraud in cross-border payments. Open banking rules in most regions are promoting interoperability and innovation, enabling third-party providers to offer personalised payment services. Also, the growth in e-commerce, peer-to-peer transactions, and buy-now-pay-later facilities brings with it an intense desire for scalable, secure, and cost-effective payment infrastructures that facilitate global financial inclusion.

Cybersecurity Segment by Technology is Growing at the Highest Rate in the Emerging Technology in Fintech Market

The emerging technology in the fintech market is dominated by cybersecurity, driven by augmented digital transactions, open banking models, and decentralised finance models. European and international markets are exposed to increased threats of fraud, identity theft, and cyberattacks. Banks and other financial institutions are increasingly combining cutting-edge security technologies, such as AI-powered threat identification, biometric verification, and blockchain-based checks, to protect data and maintain strict regulatory compliance, including the GDPR and PSD2. Growing consumer demand for trust, coupled with regulatory mandates, fuels investment in cybersecurity-focused fintech innovation, ensuring secure digital finance ecosystems.

Regionally, North America Led the Emerging Technology in Fintech Market

North America dominates the market for emerging technology in fintech due to region’s rapid digital transformation, high adoption of mobile banking, and increasing demand for secure, frictionless financial services. Technologies such as AI, blockchain, open banking APIs, and cloud-based solutions are reshaping payment systems, lending platforms, and wealth management tools. Rising cybersecurity concerns further encourage adoption of advanced biometric authentication and fraud detection tools. Significant venture capital investment and regulatory backing of innovation, in the form of sandboxes and digital-first banking models, facilitate growth. Additionally, the proliferation of embedded finance and real-time payments underscores the growing role of financial technology in industries beyond traditional banking.

Moreover, Europe’s emerging technology in the fintech market is also fueled by the region’s rapid digital transformation, strong regulatory support, and widespread consumer adoption of innovative financial solutions. PSD2 and geography-specific open banking regulations enable secure data sharing, allowing fintechs to develop personalised banking, lending, and payments solutions. Increasing demand for contactless payments, AI-driven fraud detection, and blockchain-driven cross-border payments drives market growth. Moreover, Europe’s vibrant startup ecosystem, supported by accelerators and venture capital, drives innovation in digital wallets, robo-advisory, and RegTech. Increased collaboration among incumbent banks and fintech firms drives confidence and drives the adoption of innovative financial technologies across industries.

Emerging Technology in Fintech Market Report Scope :

|

Report Attribute

|

Specifications

|

|

Market Size Value In 2024

|

USD 289.8 Bn

|

|

Revenue Forecast In 2034

|

USD 2,369.8 Bn

|

|

Growth Rate CAGR

|

CAGR of 23.9% from 2025 to 2034

|

|

Quantitative Units

|

Representation of revenue in US$ Bn and CAGR from 2025 to 2034

|

|

Historic Year

|

2021 to 2024

|

|

Forecast Year

|

2025-2034

|

|

Report Coverage

|

The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends

|

|

Segments Covered

|

By Application, By Technology and By Region

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

|

|

Country Scope

|

U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa

|

|

Competitive Landscape

|

PayPal, Block, Inc., Stripe, Inc., Ant Group CO., Ltd., FIS, Adyen, Finastra, Mastercard, Revolut Ltd, Robinhood, Goldman Sachs, N26 SE, Zelle, Visa, Chime Financial, Inc.

|

|

Customization Scope

|

Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape.

|

|

Pricing and Available Payment Methods

|

Explore pricing alternatives that are customized to your particular study requirements.

|

link