Analyst flags bitcoin’s ‘dual nature’

At different times, bitcoin is treated either as a haven or as a risk asset. That “split personality” was highlighted by IG Market analyst Tony Sycamore, writes Cointelegraph.

On September 1 the asset’s price fell to $107,290, the lowest since early July. At the same time, gold notched a record high of $3,485 per ounce.

The precious metal’s rise followed a post on Truth Social by U.S. president Donald Trump about a “significant decline” in inflation.

“Prices in the U.S. have ‘fallen significantly,’ there is virtually no inflation. Except for the ridiculous, politician-approved ‘windmills’ that are destroying every state and country where they are used, energy prices are falling ‘very strongly.’ Gasoline has hit multi-year lows. And this is despite the magnificent tariffs that bring in trillions of dollars from countries that have been living off us for decades, and are once again making America strong and respected,” he wrote.

For two and a half years gold, bitcoin and the Nasdaq moved closely together. In recent weeks the link between the cryptocurrency and the metal has broken.

“That is not unusual over short periods and reflects bitcoin’s dual nature. At times it is seen as a store of value or a safe asset, and at others as risky,” Sycamore noted.

Vince Yan, co-founder of L2 platform zkLink, stressed that in 2025 the correlation between gold and bitcoin was low and at times negative. In his view, the metal remains a traditional haven, while the cryptocurrency depends more on market liquidity and investor sentiment.

“Essentially, they balance each other rather than move in parallel,” he added.

Sycamore thinks the correlation could return if a Trump administration stimulates an overheating economy and the Fed starts cutting rates amid persistent inflation. In that scenario, the cryptocurrency and the metal would both get a lift.

“The only question is where bitcoin finds support,” the expert said.

Other views

Bloomberg senior analyst Mike McGlone doubts the correlation between bitcoin and gold will return. He says the metal will likely keep outperforming the first cryptocurrency, “especially if the U.S. stock market weakens.”

$100,000 Bitcoin Has Fueled Gold; How Enduring?

It’s been about 10 months since Bitcoin first closed above $100,000, and the decisive winner has been gold. Will the trend reverse? History suggests the rock is poised to keep outperforming, particularly if the US stock market… pic.twitter.com/RPj7KuNMpR— Mike McGlone (@mikemcglone11) August 30, 2025

André Dragosch, head of European research at Bitwise, explained that bitcoin and gold behave differently depending on where market problems lie, helping investors see where risks point.

Simple rule-of-thumb to interpret BTC & Gold moves:

Gold still tends to be the better hedge against equity downside risks while BTC is the better hedge against US Treasury/bond downside risks.

So, Gold ⬆️ & BTC ⬇️:

~higher equity risks but lower bond risks.

— André Dragosch, PhD⚡ (@Andre_Dragosch) August 31, 2025

“Gold still tends to be the better hedge against equity downside risks, while bitcoin better hedges U.S. Treasury/bond downside risks,” he wrote.

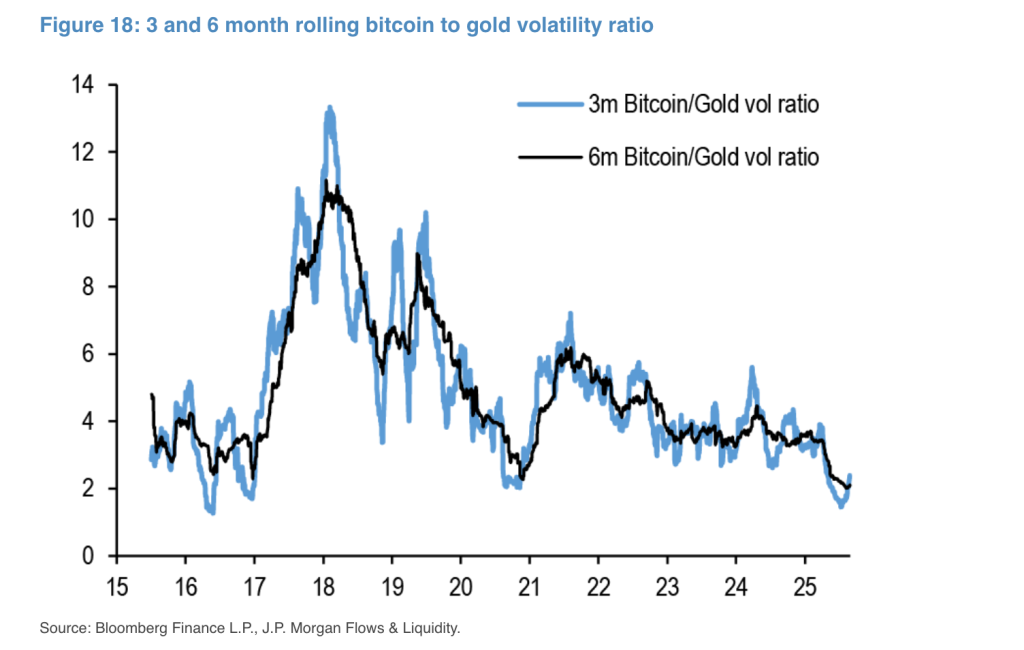

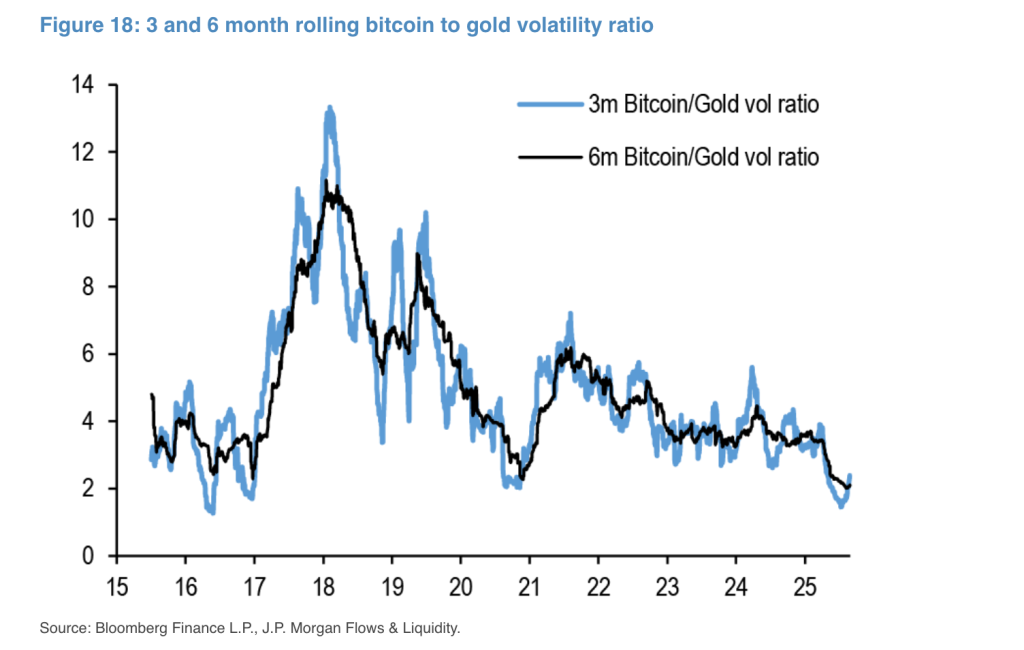

JPMorgan analysts called the cryptocurrency “undervalued” relative to the metal, reported The Block.

The ratio of digital gold’s volatility to the physical metal’s has fallen to 2.0 — the lowest on record. A surge in activity from corporate treasuries played a key role.

This implies bitcoin requires more risk capital than gold. For the cryptocurrency to match private investment in the metal, its market value would have to rise by 13%, taking the price to about $126,000.

Bitcoin criticism

Economist Peter Schiff also commented on gold’s new record, criticising bitcoin.

Gold closed at an all-time record high. If Bitcoin is digital gold, why is it more than 13% below its record high? Also, with all the hype, U.S. government support, and corporate buying, why is Bitcoin still 13% lower today than it was at its Nov. 2021 peak when priced in gold?

— Peter Schiff (@PeterSchiff) August 31, 2025

“If bitcoin is digital gold, why is it more than 13% below its record high?” he wrote.

The community criticised Schiff in response.

“Peter, gold reached its all-time high over 5,000 years of existence. Bitcoin is under 17 years old, it has already absorbed trillions of dollars in liquidity, survived three 80% drawdowns, shrugged off bans in China, the FTX collapse and attacks from governments… and yet its market cap is $2.1 trillion,” — noted one user.

In late August, 10x Research analysts said the odds of bitcoin rising to $200,000 are “extremely low.”

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!

link