Ethereum Whale Activity Intensifies Pressure on Bitcoin

The correction of digital gold is set to continue due to a record surge in leverage and a significant capital flow into the second-largest cryptocurrency by market capitalization. This was stated by Vetle Lunde, Head of Research at K33.

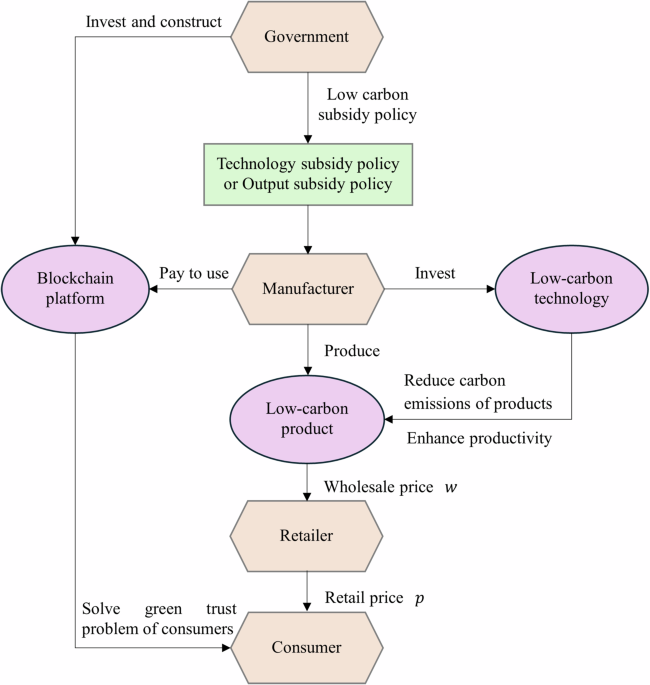

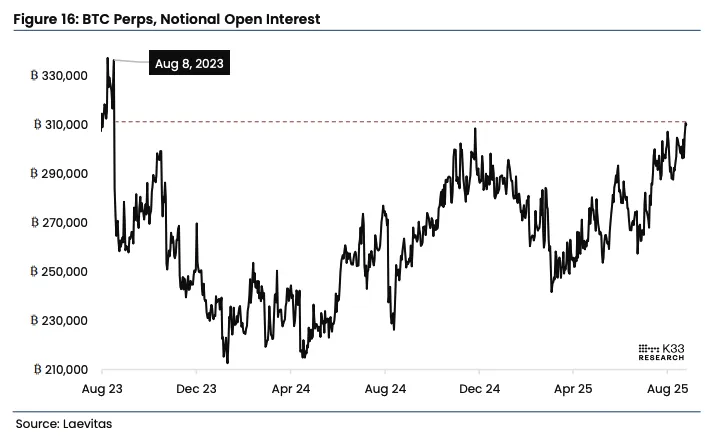

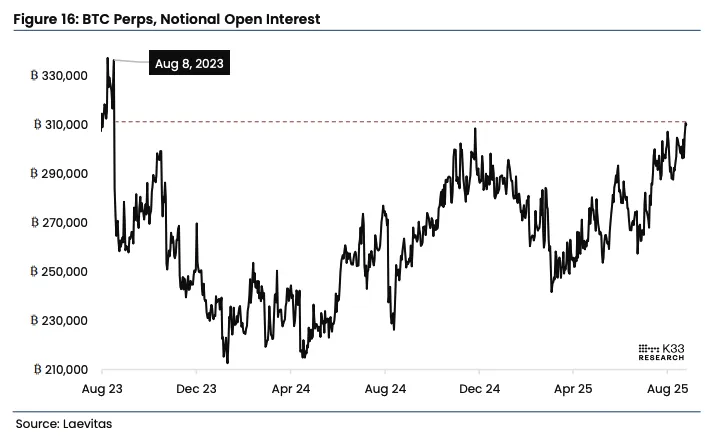

According to him, the nominal open interest in bitcoin futures has reached a two-year high of 310,000 BTC ($34 billion). Over two months, the figure increased by 41,607 BTC, and over the past weekend, it rose by 13,472 BTC. Such a sharp jump signals a potential “turning point,” the expert noted.

Simultaneously, annual funding rates have risen from 3% to nearly 11%. Lunde compared the current situation to the leverage accumulation during the summer periods of 2023 and 2024, which ended with a cascade of liquidations in August.

This time, the peak occurred at the end of the month, indicating a more prolonged phase of consolidation.

“The risk of sharp declines due to mass closing of long positions has increased,” Lunde warned.

Capital Rotation into Ethereum

Additional market volatility was triggered by a bitcoin whale who last week exchanged 22,400 BTC for Ethereum through the decentralized exchange Hyperunite. This helped the second-largest cryptocurrency by market capitalization reach a new all-time high of $4,956.

The ETH/BTC ratio exceeded 0.04 for the first time in 2025, shifting market momentum towards ether.

However, Lunde noted that despite Ethereum’s rally in dollar terms, the relative performance of the crypto asset against bitcoin remains weak. Annual, biennial, and triennial figures show negative returns.

Historically, peaks in the second-largest cryptocurrency coincided with market tops — as observed in 2017 and 2021. This was usually followed by an altcoin season. This year, digital gold’s dominance stands at 58.6%, compared to 40% during previous cycles.

“While the correlation between previous ETH and BTC peaks is concerning, we have not yet reached a situation that clearly indicates an overheating of the entire altcoin market,” Lunde emphasized.

At the time of writing, bitcoin is trading around $113,300. Its price has increased by 2% over the past 24 hours.

The Ethereum rate is $4,580.

Back in late August, analysts at Swissblock identified a “rescue” support level for the leading cryptocurrency.

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!

link