SWIFT tests XRP and HBAR for blockchain cross-border payment efficiency

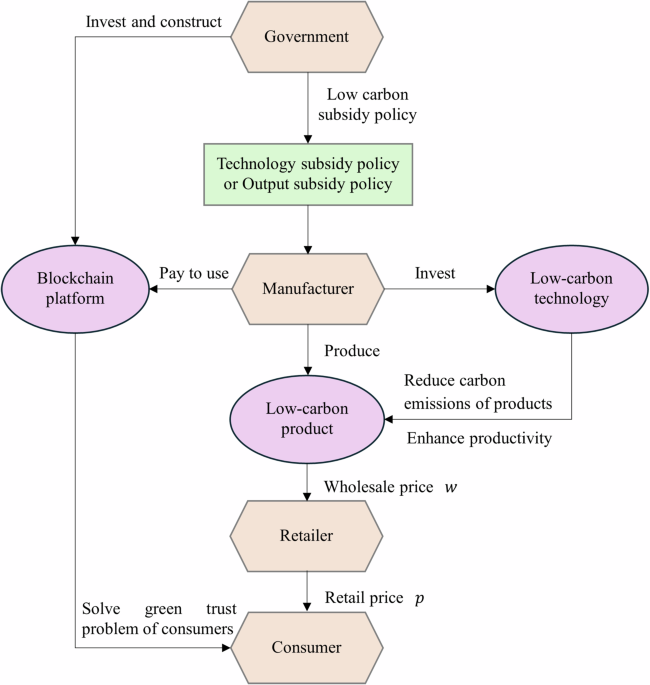

SWIFT has initiated blockchain-based trials that integrate XRP and HBAR into its global financial messaging system, signaling a strategic move toward enhancing cross-border payment efficiency and digital asset interoperability. The trials aim to align blockchain technology with traditional financial infrastructure, particularly through the adoption of ISO 20022 standards, which are essential for modernizing financial messaging [1]. With over $150 trillion in annual transactions managed through its network, even a small shift toward blockchain could significantly increase demand for these altcoins [2].

XRP and HBAR are being evaluated for their ability to facilitate fast, scalable, and energy-efficient cross-border payments. XRP, known for its near-instant settlement times and strong banking sector support, processes approximately 1,500 transactions per second while consuming minimal energy [2]. Meanwhile, HBAR leverages a hashgraph consensus mechanism, enabling over 10,000 transactions per second with similarly low energy consumption and strong corporate governance [1]. Both assets are being tested for their potential to streamline asset transfers and support tokenization in a global financial context.

The trials represent a broader institutional acceptance of blockchain’s role in financial systems. Unlike speculative narratives surrounding digital assets, SWIFT’s approach emphasizes interoperability and incremental integration rather than outright replacement of existing infrastructure [1]. Analysts have noted that the trials could provide a framework for how blockchain-based solutions might complement traditional financial systems, particularly in terms of speed, governance, and standardization [2].

While SWIFT has not yet committed to long-term adoption of any specific blockchain technology, its active testing of multiple platforms reflects a recognition of the sector’s evolution and the need for flexibility [1]. The potential adoption of ISO 20022 standards in the digital asset space could set new benchmarks for global interoperability, with XRP and HBAR serving as key indicators of how blockchain might reshape financial messaging and asset transfers.

The timing of these trials coincides with broader regulatory interest in digital currencies, such as Hong Kong’s stablecoin sandbox and China’s exploration of yuan-backed stablecoins [3]. However, these regional initiatives remain in early stages compared to SWIFT’s more advanced, institutional-level testing.

SWIFT’s blockchain trials underscore a cautious yet significant step toward bridging traditional finance with next-generation digital infrastructure. As the trials continue, the market will be watching closely for signs of long-term strategy, with XRP and HBAR positioned to benefit from increased institutional validation and standardization efforts [2].

Source:

[1] AInvest, [https://www.ainvest.com/news/xrp-news-today-swift-digital-trials-put-xrp-hbar-spotlight-blockchain-integration-2508/](https://www.ainvest.com/news/xrp-news-today-swift-digital-trials-put-xrp-hbar-spotlight-blockchain-integration-2508/)

[2] Times Tabloid, [https://timestabloid.com/confirmed-xrp-will-directly-benefit-from-swifts-live-digital-asset-trials/](https://timestabloid.com/confirmed-xrp-will-directly-benefit-from-swifts-live-digital-asset-trials/)

[3] The Standard (HK), [

link